E3 Revenue Share

Attract and Earn!

Revenue Share: The Basics

*note: this is a condensed breakdown of Rev Share and the Commission, please defer to the ICA for full list of applicable terms and conditions*

Model Levels (E1, E2, & E3)

The basis for Rev Share is dependent on your chosen Commission Model - if you can't remember the model you chose when signing your ICA, simply email Rob and he can let you know what you chose. The next building block for Rev Share is attraction. As you attract agents to join the company, a % of the company retained dollar (AGCI) is paid out per transaction (up to the agent's applicable cap). As your attracted agents continue to attract additional agents themselves, and as you meet necessary Front Line Qualifying Active (FLQA) requirements, additional lines of Rev Share will continue to open yielding additional opportunities to earn a % of the company retained dollar.

Let's dive in!

E1

E1, also known as the Flat Fee Model, incurrs transaction fees as follows:

100% less a flat fee. Flat fee is determined by sales price of transaction. $100 fee / $100,000 sales price, with a minimum flat fee of $500.

Example:

- If the sales price is less than $600,000, the flat fee is $500.

- If the sales price is $600,000, the flat fee is $600.

- If the sales price is $695,000, the flat fee is $600.

- If the sales price is $700,000, the flat fee is $700.

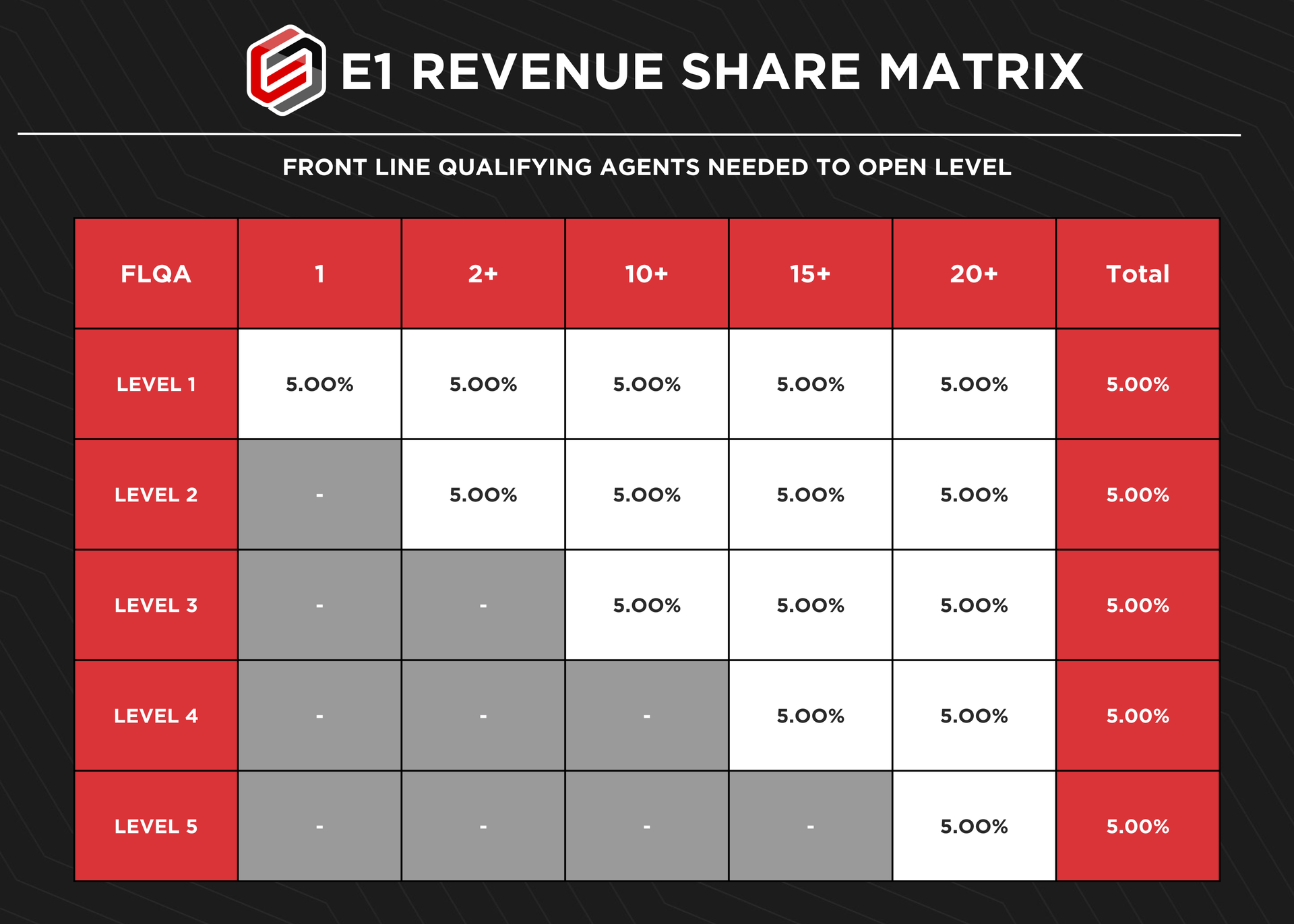

Revenue Share: See E1 Rev Share Matrix (5% per Level)

E2

E2, also known as the 85/15% Model, incurrs transaction rate of 15%, per transaction closed, until the company cap of $25,000 has been reached.

Example:

- 2.5% Listing Commission on a $600,000 sale = $15,000 GCI. 15% x GCI = $2,250 (AGCI)

- 3% Purchase Commission on a $400,000 sale = $12,000 GCI. 15% x GCI = $1,800 (AGCI)

Company Cap: $25,000

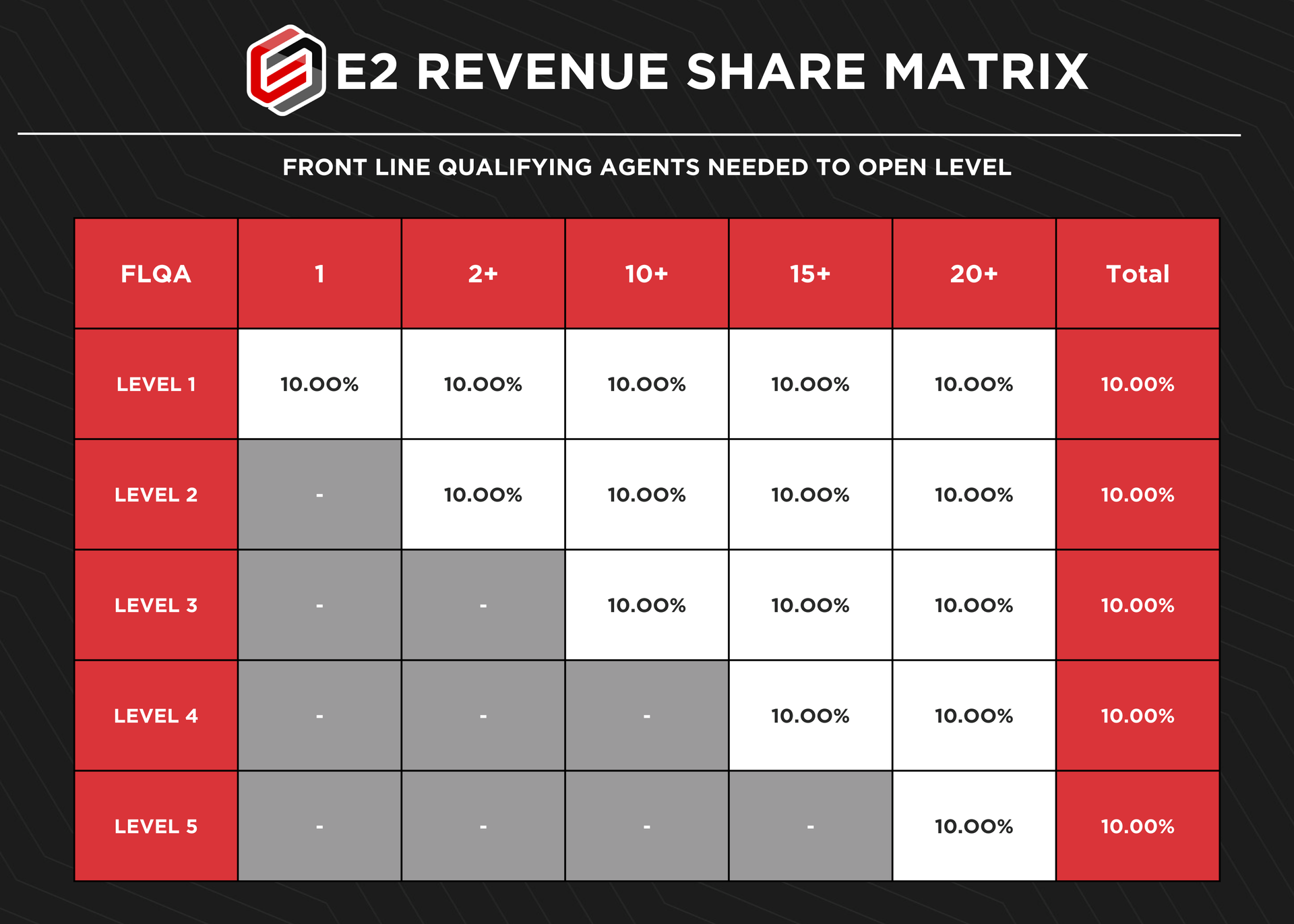

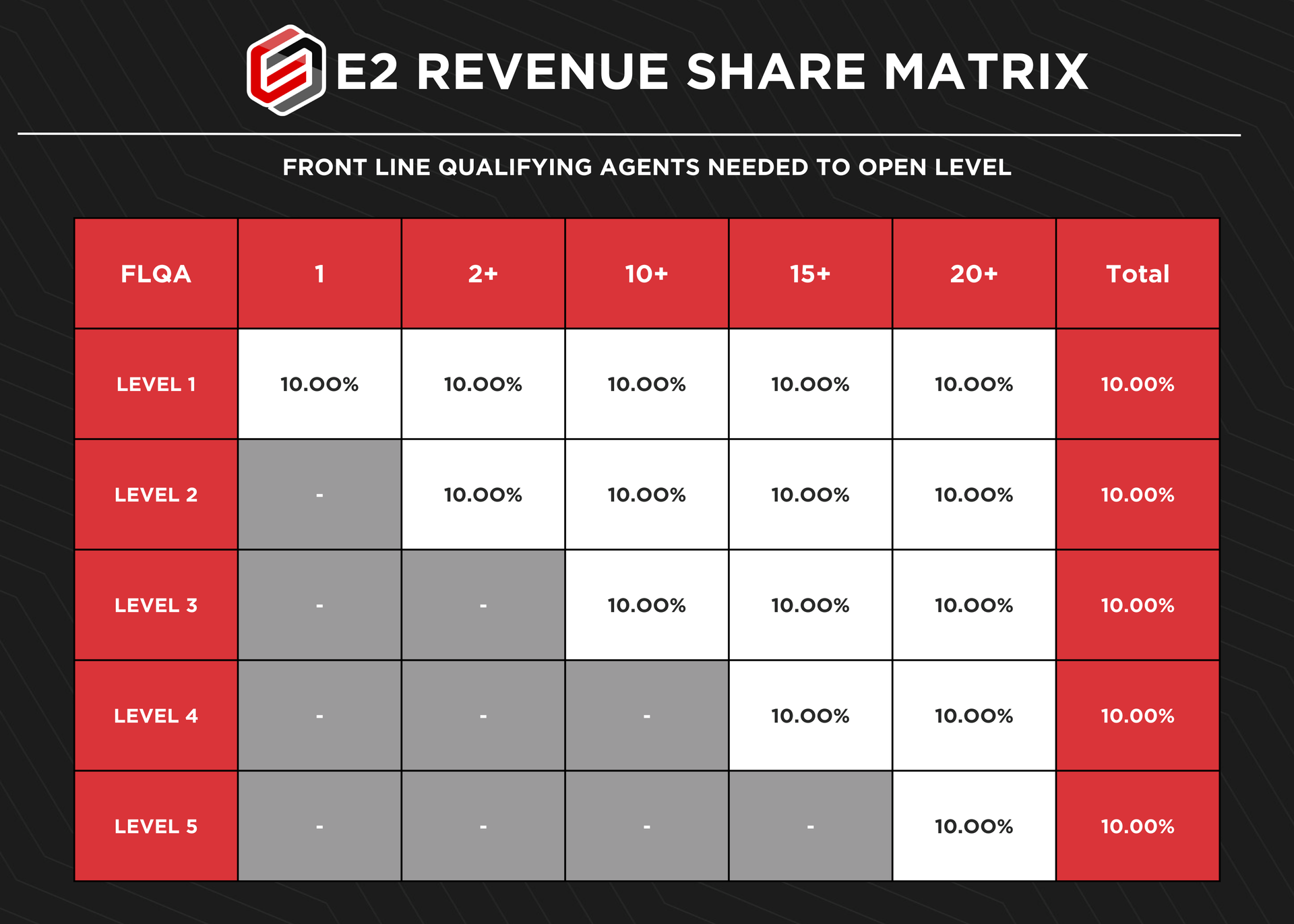

Revenue Share: See E2 Rev Share Matrix (10% per Level)

E3

E2, also known as the 75/25% Model, incurrs transaction rate of 25%, per transaction closed, until the company cap of $25,000 has been reached.

Example:

- 2.5% Listing Commission on a $600,000 sale = $15,000 GCI. 25% x GCI = $3,750 (AGCI)

- 3% Purchase Commission on a $400,000 sale = $12,000 GCI. 25% x GCI = $3,000 (AGCI)

Company Cap: $25,000

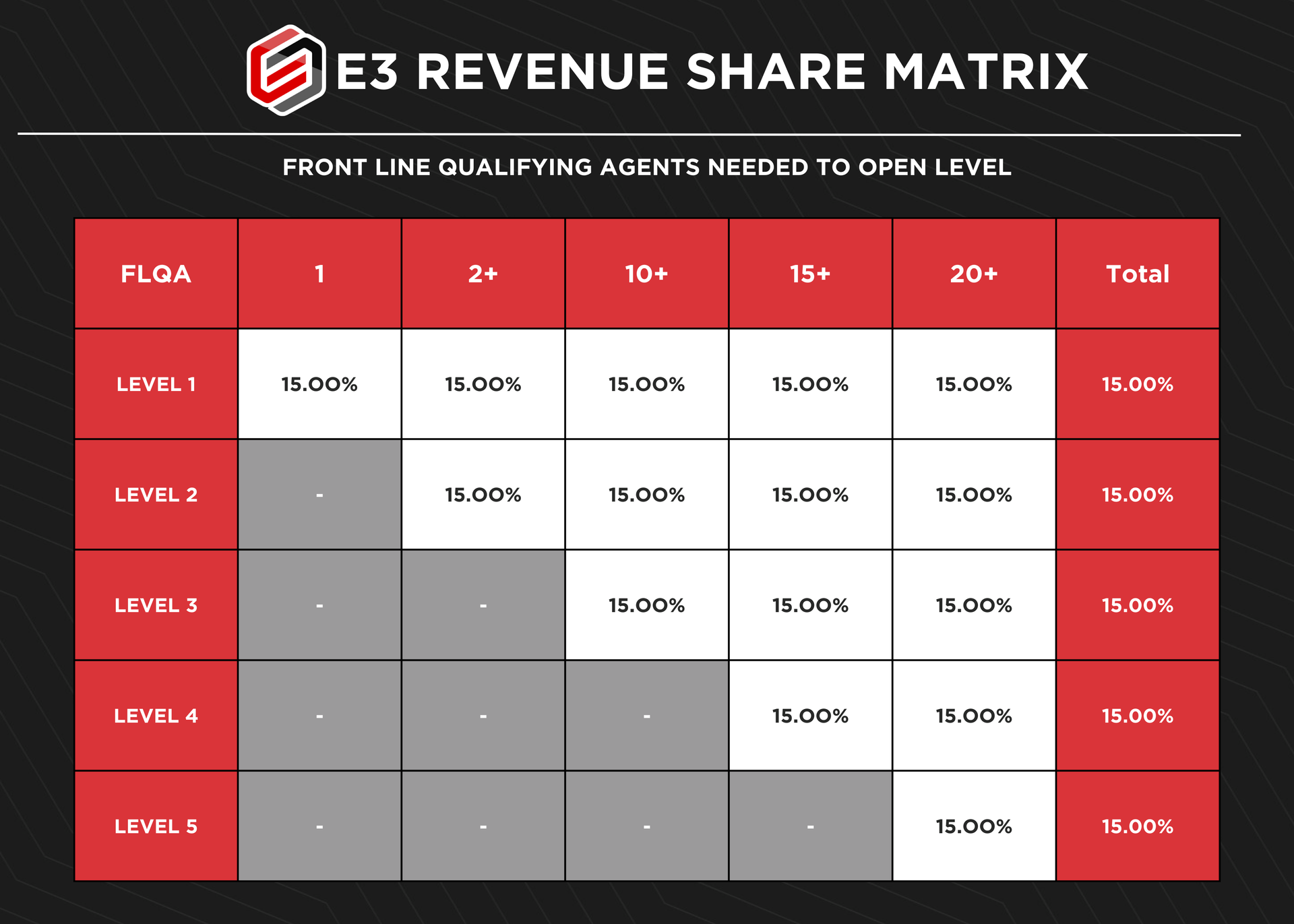

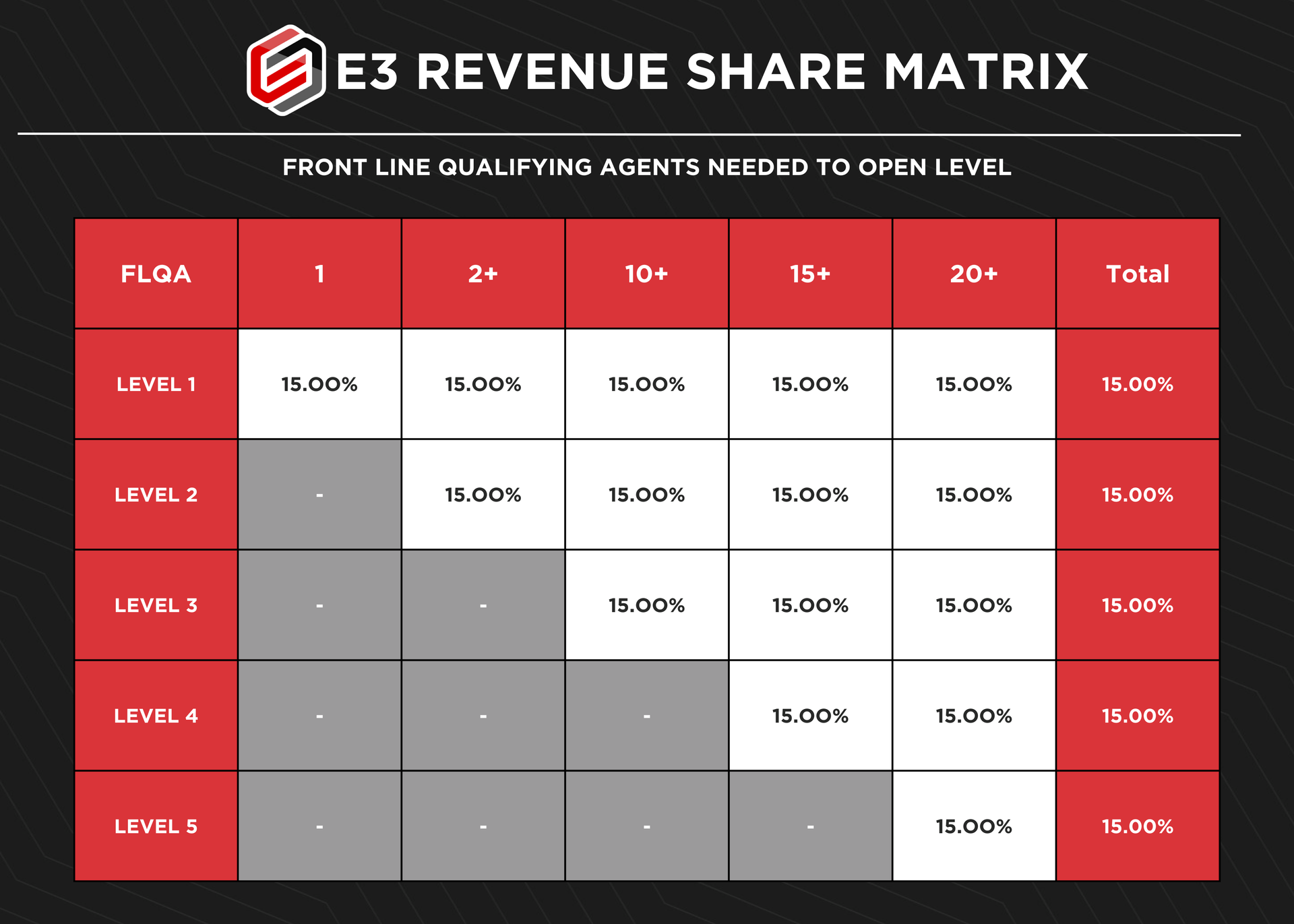

Revenue Share: See E3 Rev Share Matrix (15% per Level)

Rev Share Matrix's and How to Read Them

Let's Break Down Hot To Read the E1 Matrix

Front Line Qualifying Active (FLQA)

*see the top red horizontal highlight area*

You will see numbers ranging from 1, 2+, 10+, 15+, and 20+. These numbers represent the number of Front Line (Level 1) agents, who have met the requirements to be considered FLQA, and who YOU have personally attracted to the company and have put YOU as their sponsor when joining E3.

As your number of Front Line Qualifying Agents grows, you will be able to meet the requirements to open each subsequent vertical level and in turn unlocking further levels of Rev Share.

Example:

One (1) FLQA, who put you as their sponsor, opens up Level 1

Two (2+) FLQA in your direct Level 1 Downline opens up Agents in your Level 2

Ten (10+) FLQA in your direct Level 1 Downline opens up Agents in your Level 3

Fifteen (15+) FLQA in your direct Level 1 Downline opens up Agents in your Level 4

Twenty (20+) FLQA in your direct Level 1 Downline opens up Agents in your Level 5

Looking to the E2 & E3 Matrix's

As we look to the other matrix's, the only thing that changes is the % given in Level 1 and what is unlocked via each subsequent Levels

Example: How Your Downline Might Look

Rev Share Calculator

FAQ

How is Rev Share Calculated?

Rev Share is calculated based on the Company Retained Dollar (or AGCI) per transaction, up until that agent caps (E2/E3).

Based on your chosen Model, you will be paid out either 5, 10, or 15% of the AGCI retained by the company per transaction closed by an agent in your active unlocked level/downline.

What is FLQA and what are the requirements?

FLQA, or Front-Line Qualifying Active (Agent) describes the status of a given agent who is currently an active member of E3. The agent must be active and productive with the Company during the prior rolling six-month period by closing. There are two ways an agent in your Front Line can qualify to be a FLQA, they are as follows:

- A minimum of two full credit Sales, or the equivalent

- $5,000 in Gross Commission Income

What is AGCI?

AGCI, or Adjusted Gross Commission Income, is the % of the transaction that is retained by the company and used to calculate Rev Share.

Example: The Transaction Fee amount for E1, the 15% for E2, and the 25% for E3 (up to the $25,000 cap for E2/E3)

What is the max dollar amount I can earn on Rev Share?

While there is no maximum that can be earned overall via Rev Share, it is important to remember that agents on both E2 and E3 models do have a cap of $25,000 with the Company. In doing so, once that cap is reached, there will no longer be any funds retained under the AGCI umbrella to distribute as Rev Share until the agents anniversary year resets and in turn so does their cap.

Max Rev Share Per E2/E3 FLQA in your unlocked/active downline:

E2: $25,000 x 10% = $2,500

E3: $25,000 x 15% = $3,750

When is Rev Share Calculated & Paid out?

Rev Share is calculated the first two weeks of the month for the month prior, to ensure all transaction slated to close the month prior have done so and appicable checks have been received from Escrow. As well as to ensure all applicable metrics for qualifying as FLQA are reviewed and approved.

Rev Share is paid out on or around the 15th of each the Month, or the nearest weekday following if the date lands on a holiday or weekend.

Follow, Like, Comment & Share